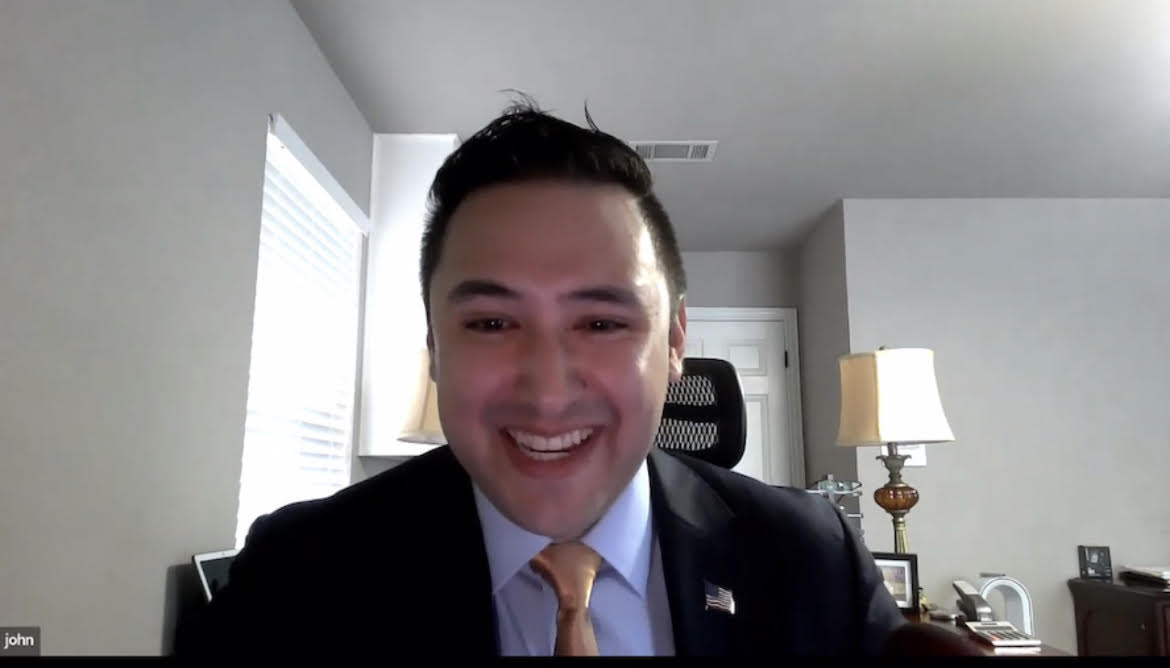

John Anthony Castro, a 2024 GOP U.S. Presidential Candidate who notably sued Donald Trump, has been found guilty on all 33 counts related to Federal Tax Fraud. Castro, a frequent guest on The NeoLiberal Round Podcast, had gained attention by suing Trump for violating Section 3 of the 14th Amendment. His legal challenges were discussed extensively on the podcast series “Castro v. Trump,” where he was a key contributor.

According to Erin Dooley at the Media Affairs Office at the Texas Department of Justice, in a press release stated that

Following a five-day bench trial before Senior U.S. District Judge Terry R Means, he was convicted on all 33 counts of assisting in the preparation of a fraudulent return and was immediately taken into custody” (Press Release by the DOJ on Friday May 24, 2024: https://www.justice.gov/usao-ndtx/pr/mansfield-tax-preparer-convicted-33-counts-tax-fraud-after-bench-trial).

Despite his high-profile legal battles, Castro’s lawsuits in multiple states were largely dismissed. In January, he filed an appeal in Florida against Judge Eileen Cannon’s decision to dismiss his case and sought her recusal from all cases involving Trump, citing bias. Concurrently, Castro faced his own legal troubles, being indicted on Federal Tax Fraud charges.

In January 2024, The NeoLiberal Round Podcast released an episode featuring Castro, where he vehemently denied any wrongdoing related to the indictment. He explained the errors leading to the charges and stated that he had taken steps to correct them. Castro expressed confidence in his ability to clear his name and reiterated his commitment to his presidential campaign.

On April 16, 2024, Castro provided an update, maintaining his innocence and preparing for his May 20th hearing. He indicated plans to testify and expressed a desire to step away from politics afterward. However, following the hearing, on May 20th, Castro was arrested and taken into custody.

The Texas State Department of Justice released details of the ruling, revealing that Castro, owner of the virtual tax preparation business Castro & Company, had falsely inflated client tax returns. Convicted on all 33 counts of assisting in the preparation of fraudulent returns, Castro now faces up to 99 years in federal prison, with each count carrying a potential three-year sentence.

Evidence presented in court demonstrated that between 2017 and 2019, Castro filed over 1,900 tax returns for clients worldwide, promising significantly higher refunds by claiming fraudulent deductions. Undercover IRS agents and client testimonies revealed Castro’s deceitful practices, including filing returns without client consent and making false deductions.

Despite taking the stand in his defense, Castro admitted to extreme and unsupported legal positions and vindictive actions against clients who challenged him. Many victim-taxpayers have faced audits and significant financial hardship as a result.

IRS Criminal Investigation conducted the investigation, and Assistant U.S. Attorneys P.J. Meitl and Nancy Larson prosecuted the case. Erin Dooley, Media Relations Officer at the DOJ, provided the press release detailing the conviction and its implications.

Reference:

Dooley, Erin, Mansfield Tax Preparer Convicted of 33 Counts of Tax Fraud After Bench Trial, https://www.justice.gov/usao-ndtx/pr/mansfield-tax-preparer-convicted-33-counts-tax-fraud-after-bench-trial

McKenzie, Renaldo Feat, John A Castro, Castro V Trump Series, by The NeoLiberal Round Podcast/The Neoliberal Corporation:

McKenzie, Renaldo, Featuring John Anthony Castro. Castro Declares Innocence to Federal Tax Charges on The Neoliberal Round. The Neoliberal Round Podcast. Philadelphia PA. April, 2024. (see link below)

Submitted by Renaldo C. McKenzie, Senior Editor/Content Chief

Renaldo McKenzie is the Author of “Neoliberalism, Globalization, Income Inequality, Poverty and Resistance,” and two other new books to be released this month.

Visit our Store: https://store.theneoliberal.com

SUPPORT US

I do trust all the ideas youve presented in your post They are really convincing and will definitely work Nonetheless the posts are too short for newbies May just you please lengthen them a bit from next time Thank you for the post

Thank you for the suggestion. We are working on providing a mix of short and long blogs, editorials and news articles. You may also share you letters and essays with us for publication.

I just could not leave your web site before suggesting that I really enjoyed the standard information a person supply to your visitors Is gonna be again steadily in order to check up on new posts