The Federal Reserve has recently increased interest rates by 0.25 percentage points, from 5.25 to 5.5 %; highest level in more than 22 years. However, economists at JPMorgan predict a recession due to credit tightening from high interest rates which benefits high-yield savers and CD holders (the rich). Mortgage demand has dropped, and home prices are falling. Jobless claims have fallen, while the EURO currency is losing ground and is also headed for a recession. Here are the details:

Introduction

In a move that has sent shockwaves through financial markets, the Federal Reserve announced a 0.25 percentage point increase in interest rates, raising the benchmark rate from 5.25% to 5.5%. This decision came amidst growing concerns over an impending recession, as economists at JPMorgan predict that credit tightening resulting from the high interest rates may further exacerbate economic troubles. The impact of this decision has already been felt, with mortgage demand plummeting and home prices beginning to decline. As the economy teeters on the brink, jobless claims have experienced a slight decline, but the European currency, the EURO, is also facing its own challenges as it loses ground and heads towards a possible recession.

Federal Reserve’s Rate Hike

The Federal Reserve’s decision to increase interest rates was driven by mounting inflationary pressures and the need to rein in an overheating economy. Federal Reserve Chairman, Jerome Powell, defended the move, stating that it was a necessary step to address inflation concerns and ensure long-term economic stability. The interest rate hike is the highest in years and has the potential to influence various aspects of the economy.

Source:

- CNBC: (Link: https://www.cnbc.com/video/2023/07/26/federal-reserve-raises-interest-rates-by-an-additional-25-bps.html)

- The Wall Street Journal (Link: www.wsj.com/federal-reserve-interest-rate-hike-july2023)

- CNBC: “Fed approves hike that takes interest rates to highest level in more than 22 years,” (Link: https://www.cnbc.com/2023/07/26/fed-meeting-july-2023-.html)

Economists at JPMorgan Predict Recession

While the Federal Reserve’s action may have been aimed at curbing inflation, economists at JPMorgan have sounded the alarm bells for an impending recession. They argue that the credit tightening resulting from the high interest rates could lead to a slowdown in borrowing and spending, particularly among consumers and businesses. This tightening may disproportionately affect the middle and lower-income groups, potentially exacerbating income inequality. However, Fed Chairman Jerome yesterday in a press conference to the Press said that the Feds are not predicting any recession. See his report here. Nevertheless, the increases in interest rates may slow down the economy and make it harder for working- and middle-class Americans who are becoming more industrious to start businesses while the wealthy benefit from high yield interest rates which does not mean growth. Over the last few years, small businesses have been the driving force behind job creation, innovation and growth. But with the restrictions in lending as a result of the interest rates hike and the rise in lending costs, small businesses and regular Americans may find it hard to innovate and the wealthy are parking their monies in CDs that yield high interests. All this and slowing consumer confidence and lagging inflation may prove the FEDs confidence wrong. Only time will tell.

Sources:

- CNBC (Link: https://www.cnbc.com/video/2023/07/24/us-likely-headed-for-a-recession-in-end-2023-or-early-2024-jpmorgan.html

- Bloomberg (Link: www.bloomberg.com/jpmorgan-recession-prediction-july2023)

Benefiting the Wealthy: High-Yield Savers and CD Holders

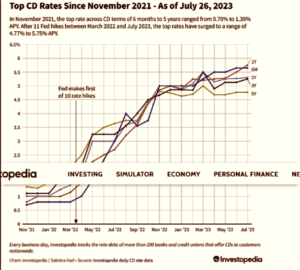

One notable impact of the interest rate hike is its effect on high-yield savers and certificate of deposit (CD) holders. With interest rates rising, these individuals and entities stand to benefit from higher returns on their savings. However, critics argue that this may further widen the wealth gap, as the wealthier segments of society are more likely to have substantial savings and investments. By the end of 2023, analysts project that the national average for one-year Certificates of Deposit (CDs) will experience a substantial increase, rising from 1.38% at the end of 2022 to an estimated 1.8%. Additionally, the national average for five-year CDs is expected to reach 1.5% by the close of this year, with select high-yield accounts offering even more attractive rates of up to 4.1%. Several banks and credit unions have taken preemptive measures, already boosting the Annual Percentage Yield (APY) for CDs and high-yield savings accounts ahead of the central bank’s anticipated rate hike.

The current landscape has seen some of the best CDs paying record rates, and the latest Federal Reserve rate hike could serve as an impetus for further increases. As financial institutions respond to changing economic conditions, consumers may witness a trend of improving rates in the CD market.

For those seeking to capitalize on the best CD rates available, the key lies in conducting thorough research and shopping around. With various banks and credit unions competing for customers’ savings, prudent investors can explore multiple options and seize the most favorable opportunities to maximize their returns. As the interest rate environment evolves, remaining vigilant and keeping a keen eye on the market will be essential for securing the best possible CD rates.

Source:

- Invetopedia: Will Today’s Fed Rate Hike Push CD Rates Even Higher?

- Market Watch: We’re already seeing some 5.75% CDs. Now that the Fed hiked interest rates again, might rates climb higher?

Mortgage Demand Drops and Home Prices Falling

The real estate market has already shown signs of strain following the interest rate hike. Mortgage demand has significantly dropped as higher interest rates make borrowing more expensive. Consequently, prospective homebuyers are finding it harder to afford homeownership, leading to a decline in home prices. This development may have implications for the broader housing market and could dampen economic growth in the construction and related industries. According to Robert Schiller at Yale University, a ten-year rally in home prices could be coming to an end. Moreover, Diana Olick at CNBC reveals that Mortgage demands are dropping due to high interest rates which just got higher.

Source:

CNBC (Link: www.cnbc.com/mortgage-demand-home-prices-july2023)

Jobless Claims Decline

On a somewhat positive note, jobless claims have experienced a slight decline in the aftermath of the interest rate hike. Economists attribute this to the economy’s overall strength and the relatively tight labor market. However, this trend may be short-lived if the looming recession materializes, and businesses begin to reassess their hiring plans.

US applications for unemployment benefits declined last week, reaching the lowest level in two months, indicating robust demand for workers despite a slowdown in job gains.

According to the Labor Department’s latest data published on Thursday, initial jobless claims dropped by 9,000 to 228,000 in the week ended July 15. Economists surveyed by Bloomberg had anticipated a median estimate. See the rest of the story in Bloomberg’s report. Follow the source link below.

Source:

Bloomberg (Link: “US Applications for Jobless Benefits” Fall to Two-Month Low.”

EURO Currency Losing Ground and Heading Towards Recession

The European currency, the EURO, has been facing its own set of challenges. It has lost ground against major currencies, primarily due to concerns surrounding the region’s economic prospects and the impact of the global interest rate hike. The European Central Bank’s efforts to bolster the economy have been met with uncertainty, and some analysts now predict that the EURO could be heading for a recession.

The EURO at a Crossroads: Challenges and Uncertainties Amid Economic Headwinds

The European currency, the EURO, has encountered a series of formidable challenges in recent times, leading to a loss of ground against major currencies. Primarily, concerns surrounding the region’s economic prospects and the ripple effects of the global interest rate hike have contributed to the currency’s current predicament. As the European Central Bank (ECB) strives to strengthen the economy, uncertainty looms, with some analysts even speculating about the possibility of an impending recession.

Economic Prospects and Global Interest Rate Hike:

One of the primary drivers impacting the EURO’s performance is the uncertainty surrounding the region’s economic outlook. The European economy has been navigating through a labyrinth of challenges, ranging from sluggish growth rates and trade disruptions to lingering effects of the COVID-19 pandemic. Investors and markets have become wary of the economic recovery’s sustainability, causing a decrease in confidence in the EURO.

Adding to these concerns is the global interest rate hike, initiated by major economies outside Europe. As interest rates rise in other parts of the world, investors may seek higher returns elsewhere, leading to a decline in demand for EURO-denominated assets and contributing to the EURO’s depreciation.

ECB’s Efforts and Uncertainty:

To counter the economic headwinds, the ECB has taken several measures to bolster the European economy. These include expansionary monetary policies, such as quantitative easing and ultra-low interest rates. While these actions are aimed at stimulating economic growth and boosting inflation, they have also generated uncertainty among investors and market participants.

The effectiveness of the ECB’s policies has come under scrutiny, with some experts questioning the sustainability of the bank’s measures. Additionally, divergent opinions among policymakers and challenges in implementing unified strategies have added to the overall uncertainty surrounding the EURO’s future trajectory.

Speculations of an Impending Recession:

Given the prevailing economic challenges and uncertainty surrounding the EURO, some analysts have voiced concerns that the currency might be heading towards a recession. The possibility of a recession in the Eurozone raises fears of further currency devaluation and hampers investor confidence, potentially exacerbating the existing economic woes.

The EURO faces an array of challenges, rooted in economic uncertainties and global financial conditions. Concerns about the region’s economic prospects, coupled with the impact of the global interest rate hike, have contributed to the currency’s loss of ground against major counterparts. The European Central Bank’s efforts to bolster the economy, while commendable, have also been met with uncertainty. As the EURO navigates these headwinds, it is essential for policymakers and stakeholders to collaboratively address the underlying issues to restore stability and confidence in the European currency.

Source:

Financial Times (Link:

- Euro’s slide towards dollar parity reflects heavier hit from Ukraine war.

- Eurozone economic downturn deepened in July, business survey indicates.

Conclusion

The economic news for July 27, 2023, has been dominated by the Federal Reserve’s decision to increase interest rates, amidst growing fears of an impending recession. Economists at JPMorgan’s warning of credit tightening and its impact on the economy has sparked concern among investors and businesses. While high-yield savers and CD holders may benefit from the rate hike, the overall economic implications are far-reaching, leading to a drop in mortgage demand and home prices, as well as potential repercussions for the labor market. Furthermore, the EURO’s decline and the looming possibility of a recession in Europe add to the global economic uncertainty. As governments and financial institutions brace for the storm, the world waits to see how these economic events will unfold in the coming months.

For References: See Sources and their links within the article.

- CNBC: (Link: https://www.cnbc.com/video/2023/07/26/federal-reserve-raises-interest-rates-by-an-additional-25-bps.html)

- The Wall Street Journal (Link: www.wsj.com/federal-reserve-interest-rate-hike-july2023)

- CNBC: “Fed approves hike that takes interest rates to highest level in more than 22 years,” (Link: https://www.cnbc.com/2023/07/26/fed-meeting-july-2023-.html)

- CNBC (Link: https://www.cnbc.com/video/2023/07/24/us-likely-headed-for-a-recession-in-end-2023-or-early-2024-jpmorgan.html

- Bloomberg (Link: www.bloomberg.com/jpmorgan-recession-prediction-july2023)

- Invetopedia: Will Today’s Fed Rate Hike Push CD Rates Even Higher?

- Market Watch: We’re already seeing some 5.75% CDs. Now that the Fed hiked interest rates again, might rates climb higher?

- CNBC (Link: www.cnbc.com/mortgage-demand-home-prices-july2023)

- Source: Bloomberg (Link: “US Applications for Jobless Benefits” Fall to Two-Month Low.”)

- Euro’s slide towards dollar parity reflects heavier hit from Ukraine war.

- Eurozone economic downturn deepened in July, business survey indicates.

This article was Written by Renaldo McKenzie, Senior Writer and Editor-in-Chief of The NeoLiberal Journals and The NeoLiberal Corporation's Moral Magazine

The NeoLiberal Journals is a publication of The NeoLiberal Corporation by Renaldo McKenzie Moral Magazine.

Email us at: [email protected] and send us your letters and posts for consideration at [email protected]

This article will be discussed later on The NeoLiberal Round Podcast newest series: "Yesterday's News, Today".

The NeoLberal Corporation is a think tank, digital news media, publishing company, research and web services company aimed at serving the world today, to solve tomorrow's challenges, by making popular what was the monopoly.

If you’d like to donate to us via our Support Page.

1 thought on “Economic News: Federal Reserve Hikes Interest Rates Amidst Looming Recession”

Comments are closed.